Spectacular Info About What Is An Example Of Shorting

Understanding Short Selling

1. What Exactly Is Shorting?

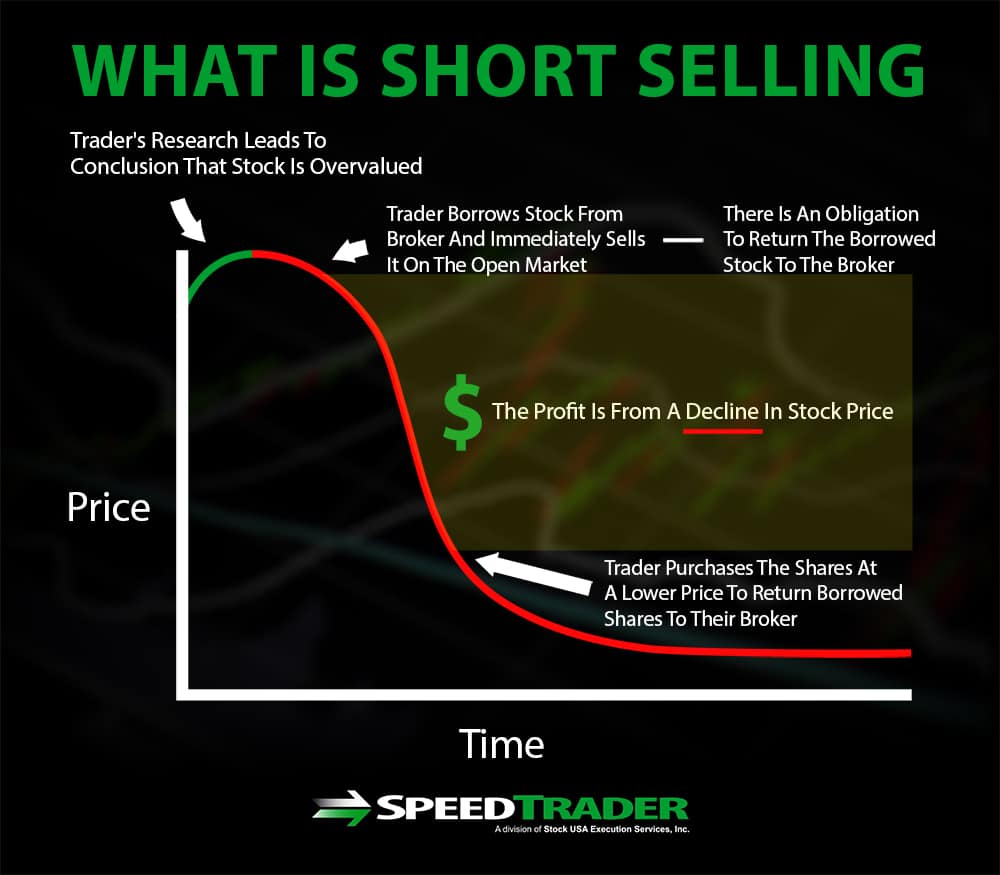

Okay, imagine you think the price of your neighbor's prized stamp collection is about to plummet. Maybe a rare stamp got damaged, or a new, even rarer stamp was discovered. You want to profit from this anticipated decline, but you don't own any stamps yourself. That's where short selling, or "shorting" as it's often called, comes in. It's essentially betting against something.

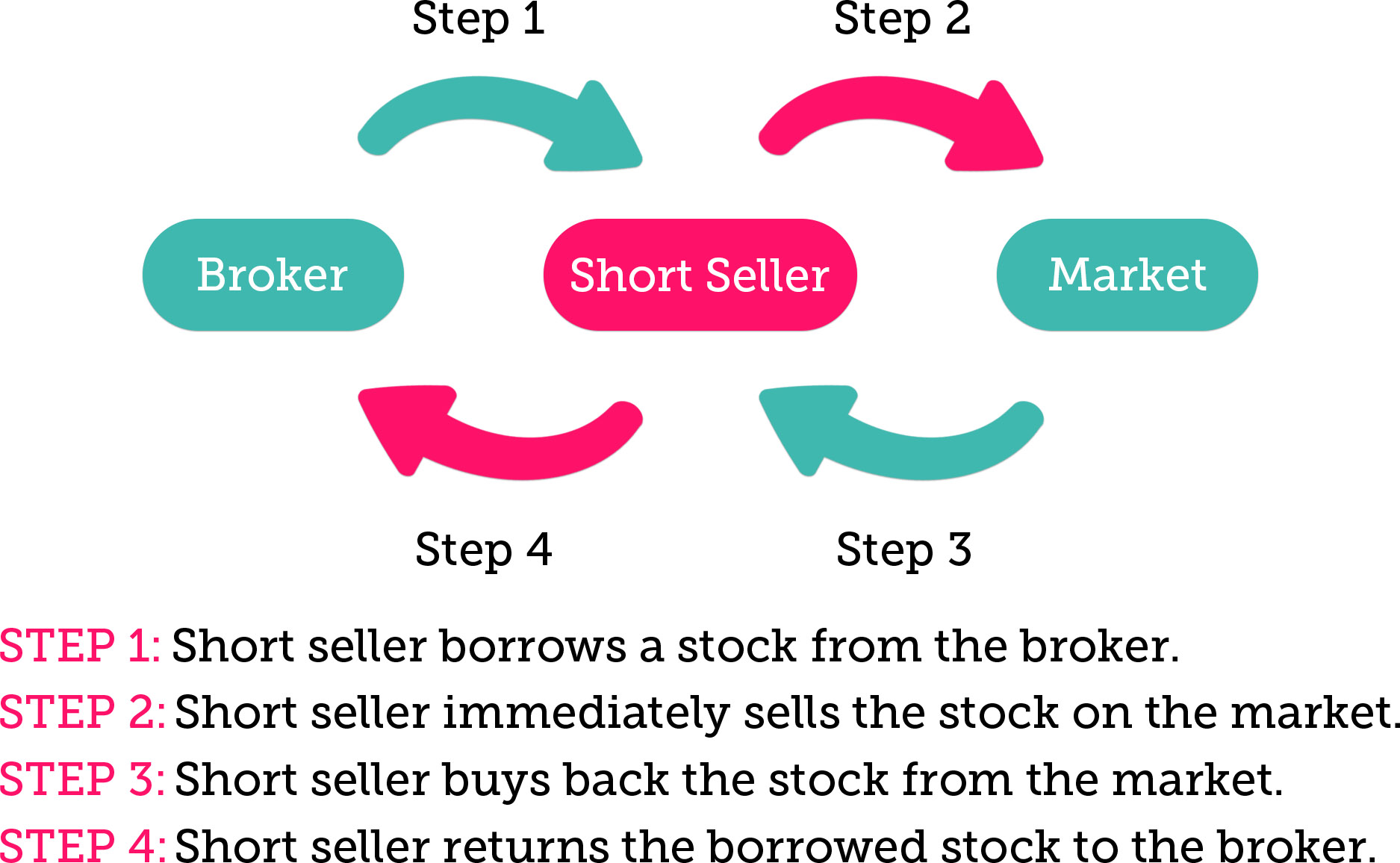

Instead of buying low and selling high (the traditional way), you're borrowing those stamps (or, more realistically, shares of a company's stock) from someone else. You then sell them immediately at the current, higher price. The hope? The price drops. If it does, you buy the stamps back at the lower price, return them to the lender, and pocket the difference. Think of it as borrowing something, selling it, then buying it back later for less and giving it back.

So, in essence, shorting is a strategy where an investor borrows an asset, sells it with the expectation that its price will decrease, and then buys it back at a lower price to return to the lender, profiting from the difference. It is a sophisticated and risky way to potentially make money when you think an asset's price is going down. Think of it as betting that things are going to get worse!

Of course, this whole thing hinges on being right about the price going down. If the price goes up instead of down? Ouch. You're on the hook to buy the stamps back at the higher price, potentially losing a lot of money. We'll get into those risks a bit later. Let's move onto an example to paint a clearer picture.

What Is Shortening? The Coconut Mama

A Real-World Example of Shorting

2. Putting Short Selling into Perspective

Let's say you believe that "TechCorp" (a fictional tech company) is overvalued. Their stock is currently trading at $100 per share, but you suspect a big announcement is coming that will negatively impact their stock price. It could be a product recall, disappointing earnings, or even rumors of the CEO stepping down to pursue his dream of becoming a competitive cheese sculptor. Anything's possible!

You decide to short 100 shares of TechCorp. Your broker borrows those shares from another investor who owns them. You immediately sell those borrowed shares for $100 each, netting you $10,000 (before fees and commissions, of course; brokers gotta eat too!).

A week later, your prediction comes true! TechCorp announces disappointing quarterly results. Investors panic, and the stock price plummets to $50 per share. You decide to cover your short position. This means you buy 100 shares of TechCorp at $50 each, costing you $5,000. You then return those shares to your broker, who returns them to the original lender.

Your profit? $10,000 (initial sale) - $5,000 (repurchase) = $5,000 (minus any fees or interest paid to your broker for borrowing the shares). Not bad for a week's work, assuming you're right! Remember, the key point here is that you profited from the decline in the stock price, thanks to your successful shorting strategy.

How To Sell Short A Stock Behalfessay9

The Dark Side

3. When Things Go Wrong (and They Can)

Now, here's where things get a little scary. Unlike buying a stock where your potential loss is limited to the amount you invested (the stock can only go to zero), the potential losses when shorting are unlimited. Think about it: a stock can theoretically go to infinity (okay, maybe not literally, but you get the idea). If TechCorp's stock price had increased to $150 per share instead of decreasing, you would have had to buy back those shares at $150 each, costing you $15,000. Your loss would be $5,000, plus any borrowing fees. Ouch!

Another risk is the possibility of a "short squeeze." This happens when a heavily shorted stock suddenly experiences a surge in price. Short sellers, fearing further losses, rush to cover their positions by buying back the stock, which further drives up the price. This can create a vicious cycle, leading to massive losses for short sellers.

Furthermore, you are required to maintain a margin account to short stocks, and you may receive a margin call if the price of the stock you shorted increases significantly. This means you'll need to deposit more funds into your account to cover the potential losses.

So, while short selling can be a lucrative strategy, it's definitely not for the faint of heart. It requires a strong understanding of the market, careful risk management, and a healthy dose of courage (or maybe just recklessness, depending on who you ask!).

COVIDEra Economy Investing + Swing Trading Page 6 Lipstick Alley

Why Do People Short Stocks?

4. Beyond Just Making a Quick Buck

While the primary motivation for shorting is often to profit from a decline in price, there are other reasons why investors might choose this strategy. One common reason is hedging. For example, if you own shares of a competitor to TechCorp, you might short TechCorp's stock to protect your portfolio against a potential downturn in the industry. If the industry as a whole suffers, both stocks will likely decline, but the profit from your short position in TechCorp could offset the losses in your other holding.

Another reason is speculation. Some investors believe they have superior knowledge or insight into a company's prospects and are willing to bet against the company's success. They may see warning signs that others are missing and use short selling as a way to profit from their knowledge.

Short selling can also contribute to market efficiency. By betting against overvalued companies, short sellers help to correct inflated prices and prevent bubbles from forming. This can lead to a more stable and rational market overall. Think of them as the reality check the market sometimes needs.

Ultimately, the decision to short a stock is a complex one that depends on a variety of factors, including the investor's risk tolerance, investment goals, and market outlook. It's not a strategy to be taken lightly, but it can be a valuable tool for sophisticated investors.

Shorting A Stock Your Essential Guide To Short Selling

Before You Short

5. Doing Your Homework Is Key

Before you even think about shorting a stock, do your research. Seriously, thorough research. Don't just listen to some guy on a podcast (unless that guy is Warren Buffett...and even then, be cautious!). Understand the company, its industry, its financials, and the overall market conditions. What are the potential catalysts that could cause the stock price to decline? What are the risks?

Develop a clear risk management plan. How much are you willing to lose on the trade? What is your stop-loss order? (A stop-loss order automatically buys back the stock if it reaches a certain price, limiting your potential losses.) Don't let your emotions get the better of you. Stick to your plan, even if things get volatile.

Be aware of the costs involved. Borrowing shares isn't free. You'll need to pay interest to your broker, and there may be other fees associated with short selling. These costs can eat into your profits, so be sure to factor them into your calculations. Consider the tax implications, short-term capital gains are taxed at your ordinary income rate, which can be higher than long-term capital gains rates.

And most importantly, start small. Don't bet the farm on your first short trade. Begin with a small position size so you can learn the ropes without risking too much capital. Short selling can be a challenging and rewarding strategy, but it's important to approach it with caution and a well-thought-out plan.

Shorting Vs Short Selling

FAQ

6. Your Burning Questions Answered

Still scratching your head? Let's tackle some common questions about short selling.

Q: Isn't shorting bad for the market?

A: Not necessarily. While it can be seen as betting against companies, short selling can also help to correct overvalued stocks and prevent market bubbles.Q: How do I find stocks to short?

A: Look for companies with weak financials, declining sales, or negative news. Remember, do your research!Q: What happens if the stock I shorted goes bankrupt?

A: This is a tricky situation. Your obligation is generally limited to the value of the shares at the time of bankruptcy. You'll usually need to cover the short position by buying back the shares, even if they are practically worthless. However, bankruptcy proceedings can be complex, so seek professional advice.Q: Can I short any stock?

A: No, your broker needs to have the shares available to borrow. This depends on the stock's liquidity and demand from other short sellers.